THE ONE METRIC INVESTORS CAN’T IGNORE

Growth at all costs is dead. Today, investors ask a sharper question:

How much are you burning for every dollar of Annual Recurring Revenue (ARR) you create?

What Is the Burn Multiple?

The burn multiple measures how efficiently a startup turns capital into new revenue. It has become the single metric that now dominates early-stage fundraising conversations.

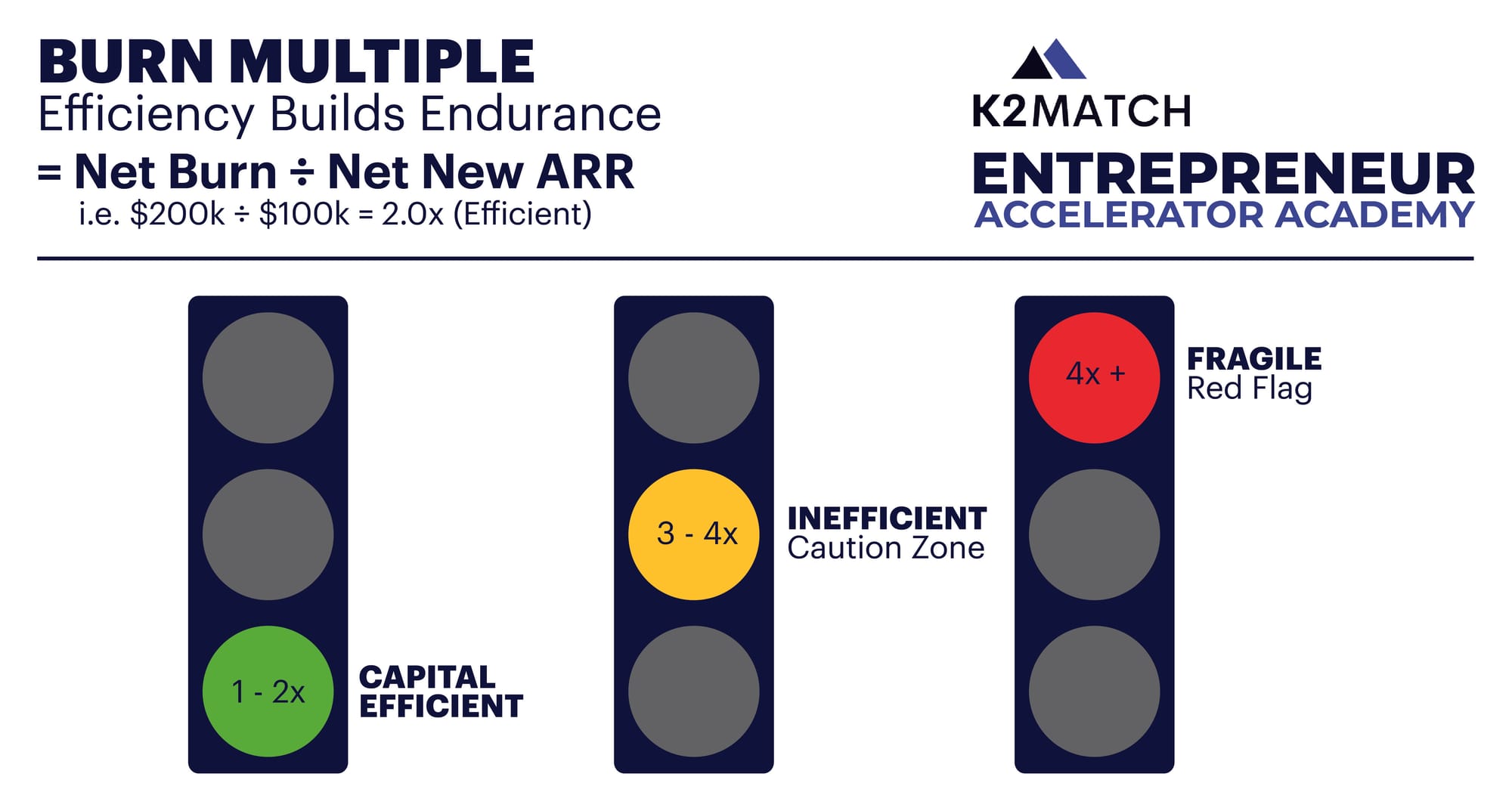

It’s calculated simply:

Net Burn ÷ Net New ARR = Burn Multiple

- A burn multiple of 1–2x signals strong efficiency: for every $1 burned, you generate $0.50–$1 in new ARR.

- A burn multiple of 3–4x suggests inefficiency: high spend with low return.

- Anything above 4x raises red flags, investors see fragility, not scale.

Why does this matter? Because investors know markets shift. Valuations expand and contract. But efficiency—the ability to create more with less—is what endures.

The Investor Lens

The burn multiple is more than a ratio. It’s an investor’s litmus test for:

- Control Does the founder know where the money is going?

- Maturity Can the team align capital to outcomes with discipline?

- Durability Will the company adapt when capital tightens, markets cool, or growth slows?

As Peter Harrison, founder of the Academy and global authority on entrepreneurial psychology, explains: “Startups rarely run out of vision. They run out of discipline. The burn multiple forces founders to confront how well they convert cash into progress. Efficiency isn’t a side note, it’s the proof of execution under pressure.” And as Badr Moudden, CEO of K2MATCH, adds: “When investors see a clean burn multiple, they see control. They see a founder who understands capital efficiency, cash flow, and responsibility. It’s one of the fastest ways investors filter companies that can endure from those that will collapse.”

Why Most Startups Struggle

Many founders obsess over the wrong scoreboard. They celebrate user counts, vanity metrics, or top-line ARR without asking what it costs to achieve.

When markets tighten, investors sharpen their filters. A flashy growth story won’t outweigh poor efficiency. If every new dollar of ARR costs four or five dollars in burn, confidence evaporates.

Worse still, many founders don’t track burn multiple at all. They can’t explain their efficiency, or they hide behind “growth mode.” To an investor, this signals risk, immaturity, and denial.

The best founders do the opposite: they face the number, improve it quarter by quarter, and use it as proof of disciplined leadership.

The Metrics That Matter

Founders who want to improve their burn multiple must also track the core drivers of efficiency. Inside the Academy, we teach the seven investor-critical metrics that make up an operationally precise dashboard:

- Runway & Burn Rate how long until cash runs out.

- Contribution Margin what’s left after direct costs.

- Capital Efficiency Ratio how much revenue you create per dollar invested.

- Customer Acquisition Cost (CAC) what it takes to win a customer.

- Lifetime Value (LTV) what a customer is worth over their lifecycle.

- Payback Period how quickly CAC is recovered.

- Net Revenue Retention (NRR) how well you hold and grow existing customers.

Together, these give investors a clear, disciplined view of your financial maturity.

The Founder’s Edge

Managing your burn multiple isn’t just about pleasing investors. It strengthens your business:

- Runway confidence extend your cash horizon without desperate cuts.

- Team clarity align everyone on how growth ties back to capital.

- Customer stability efficient companies serve customers better, not just faster.

In short: a low burn multiple isn’t just good finance. It’s good psychology, good strategy, good operations, and brilliant execution.

Building Efficiency Inside the Academy

At the K2MATCH Entrepreneurial Accelerator Academy, we help founders make burn multiple part of their leadership toolkit. Founders learn how to:

- Model burn and runway with precision.

- Calculate CAC, LTV, and contribution margins with investor-grade clarity.

- Forecast credibly, with numbers that withstand scrutiny.

- Build dashboards that prove discipline, not just ambition.

Efficiency is no longer optional. It’s a signal. And in today’s market, it’s the signal investors can’t ignore.

Are You Ready to Prove Your Efficiency?

If you want to test your investor readiness:

- Complete the K2MATCH Entrepreneur Readiness Survey (45–60 mins) or request a 1:1 meeting with Peter Harrison.

- Explore the K2MATCH Entrepreneurial Accelerator Academy, where we help founders build the numbers that investors trust.