The importance of setting up a payment plan - Making sure that we use the best and safest payment channels for our payment flow

Seems like we never hear about failure. All online channels and motivational quotes say „follow your dreams”. We only hear about success stories, but hardly talk about bad decisions, lost funds or closed businesses.

While I was working at an accounting firm, the most important skill I could gain was to learn how to look at different companies' financial information and understand why they fail or succeed. I think I have never learned more about real life businesses and startups than during my time while doing the accounting for them. Since accountants manage all company records, we see all cash flow and asset management decisions, results and long term outcomes. I was surpised how many companies actually fail and how quickly it can happen.

After creating the records for approximately 30 companies, I started to notice a pattern, which shown significant problems around payment and banking. The most common error was either the miscalculation of the risk or the underbudgeting of the banking costs. Althought banks were more relaxed with the compliance checks back then, I still saw some examples of how badly a frozen account can affect, or even ruin, an otherwise successful operation.

Working with numerous online businesses, I sadly noticed that the management often only paying attention to the obvious: setting up the marketing plan, creating a shiny website or pay a huge amount for affiliates. But it seemed like no one is thinking about setting up an actual payment plan, even though this is one of the major decisions, which can make or break the majority of the businesses.

Unfortunately, even today, way too many businesses fail due to reasons which could be easily planned for, and avoided completely. Way too many companies miss to realize that one of the most important bottleneck of their operation could be payments and banking. Following up on every step of the money flow is a relatively quick and painless exercise, and if a business spends just a a little effort to draft a plan, they already have done more than the majority of their competition.

How to set up a payment plan?

A good payment plan comes from understanding the business, and all realted parties around it, of course.

First, we need to check and understand each and every companies in the group. Where are they based, why there? We need to understand who are the directors, the shareholders and exact activity of each company, so we can understand what are the available resources we can use for our plan. Perhaps we have an offshore company under the same directorship as our trading company. This might seem like a good opportunity for tax optimization from a legal angle, however it cannot be worse from a banking perspective. Banks are responsible to eliminate any opportunity for tax evasion, and make sure the money flow is legit in every circumstances. So if we have any offshore entity in the group, this increases the group’s risk score overall, and put every company in the group to a higher risk category, which can result in raised banking costs and denied onboarding.

Next step is to understand the relationship between these companies. We need to consider how these entities are trading with each other in order to make sure that the payment flow is understood and optimised. If we are transferring money between two companies, we always have to have a good reason for that, such as invoices or agreements. The pricing has to align with the market standards in order to mitigate any opportunity for tax evasion. Gift is not a accounting term, and every ime money moves, this creates a potential tax point, too.

Once we understood how these companies are trading with each other, we need to understand what type of banking and payment provider agreements we have already in place. Many times the existing providers are evolving and offering potentially more suitable and cheaper financial products or services, but we might not even be aware of them. As we know, the government’s banking guarantee ends at EUR 100 000 in Europe. We could also discover opened, but unused bank accounts, which might be perfect opportunity to mitigate such risk. Often we find funds which are „parked” on some accounts for a while. Without a treasury function, the value of these unused funds are quickly decreasing due to inflation.

After we understood the current setup, we shall check the fees and terms with the exisiting providers. Administrative issues, such as non signed or expired contracts can be easily corrected and can worth thousands of Euros in case these contracts are needed during a potential misunderstanding or legal proceeding. Our group has also evolved over the years, bringing more volume or better organisational setup, so here we might have a good opportunity to renegotiate the fees or terms with the current providers, and get better options. No one wants to lose a good customer.

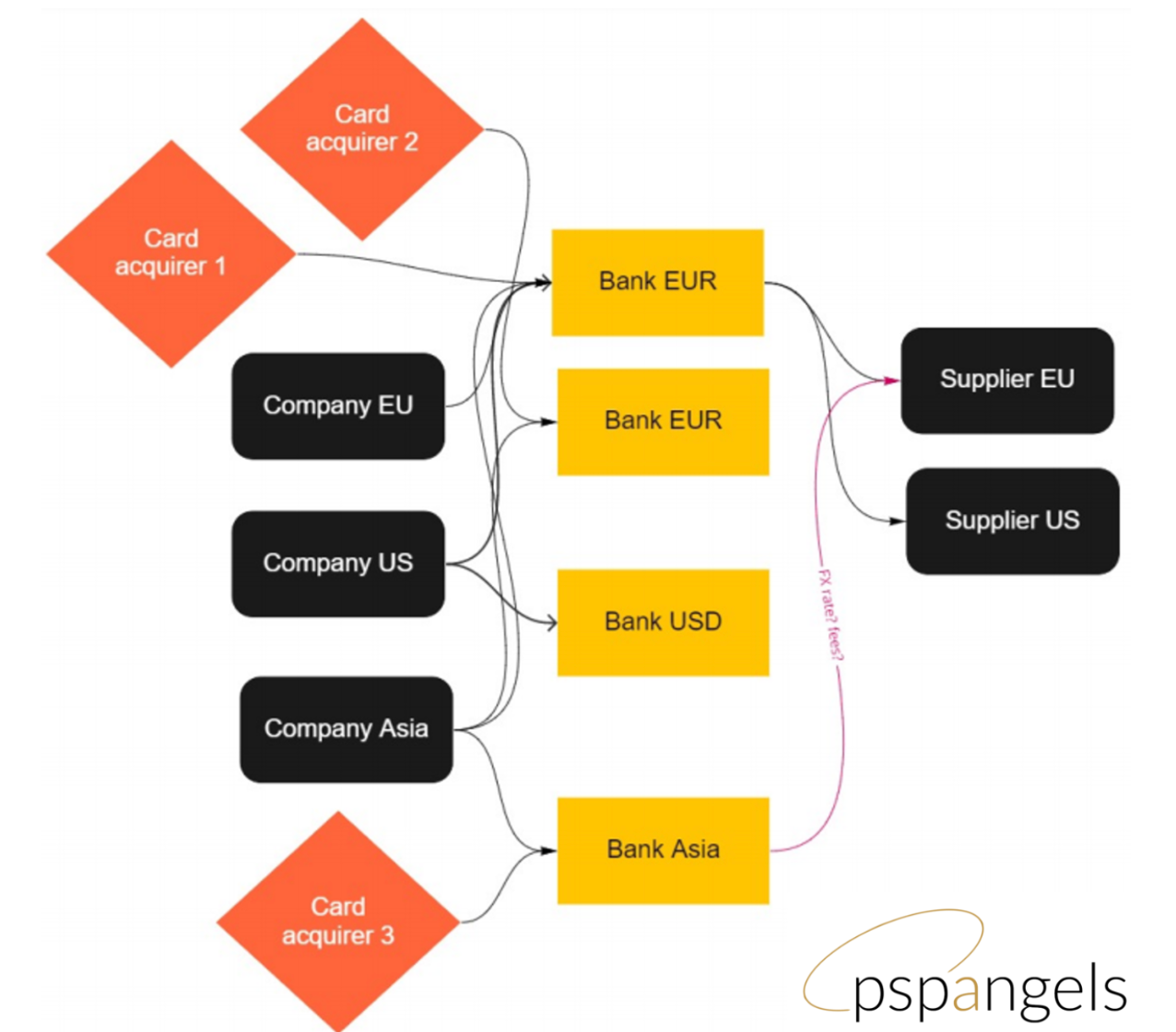

Next step is to see how the funds actually flow though the group. What are the incoming amounts? Outgoings? How much? How often? In what currency? Where the funds are kept? For how long? How do we pay our suppliers and salaries? Which companies are involved in the group for the fund’s handling?

Once we set up the exact payment flow, we can easily identify the risky or less cost effective areas. This step can also help in the tax optimisation and evaluate the various timelines. With the involvement of a treasury expert, the group’s funds can be put into work and generate a significant amount of side revenue to the group. With international groups, we shall also evaluate the costs of the foreign exchange currency transfers, as banks usually charge more than specialised FX providers.

Lastly, the ongoing monitoring is absolutely essential when we are setting up a payment plan. Whatever is perfect today might be the worst route for our money flow tomorrow. Everything is evolving and changing all the time, our business, the technology, the providers, the banks and the regulations. Payment planning is dynamic and requires ongoing attention. Businesses need to be agile, ready to adapt their payment strategies to new challenges and opportunities as they arise.

Payment planning is a complex but necessary way to optimize cash flow, manage risks, and prepare a business for both current and future financial challenges and opportunities. By understanding its imoportance and details, a business is better positioned for sustainable growth and long-term success.