Getting Financed - Successful Venture Finance for Startups

I attended the New York Venture Finance Summit on 4-5 September and came away heavily impressed by the dynamism and rapidity of the US venture capital market. Together with the experience of raising capital for my electric motorcycle startup, I’d like to provide some insight into what investors are looking for these days. Along the way, I’ll share some insights from the last 12 months of startup operations and angel investment placements, as well as some experience from Web Summit, the EBAN Conference and other events.

Step 1: Know where you are in the Startup Finance Cycle

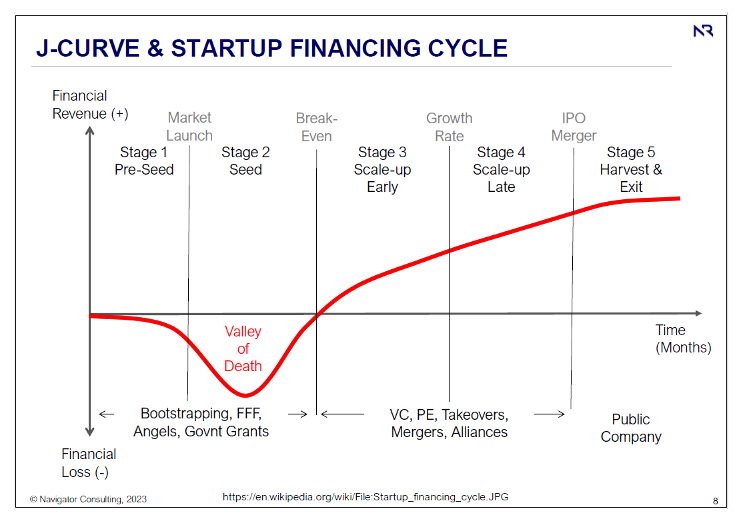

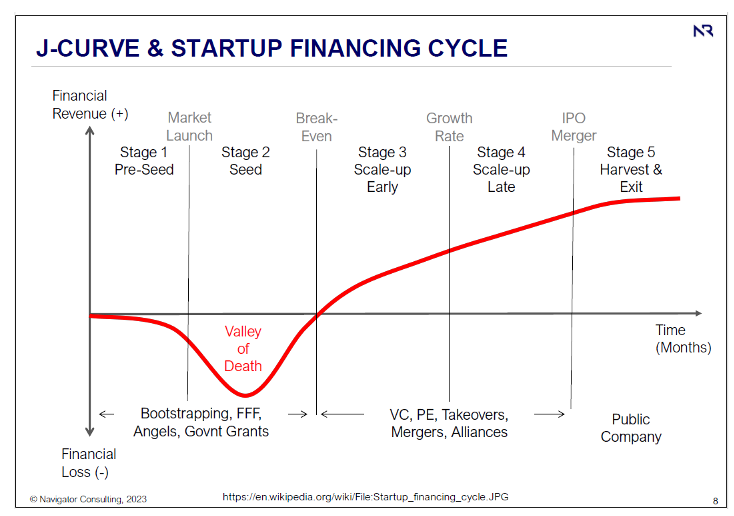

We often refer to the JCurve for Startup Finance as a conceptual guide to financing, which is often presented as the chart below. What this chart does show is how investors evaluate risk depending on where you are in the cycle.

We can probably establish three sub-phases in the J-Curve that you should focus on:

Phase 1: From Idea to Bench Prototype

This is a measurement of the risk, time, effort and cash requirement needed to produce your first minimum viable product (MVP) or prototype. When we refer to a bench prototype, we refer to a working prototype usually in beta mode, without real customer engagement. There are two inverse relationships you should be aware of:

· If the timeline from idea to bench prototype is long, this implies higher risk of technical, market or team failure. If the amount of money you are asking for is also large, this is seen as commensurately negative, especially if you are not in a segment where there is a heavily defensible situation.

· Conversely, if the timeline from idea to bench prototype is short, then many investors will want to know why you haven’t bootstrapped your way there already.

Phase 2: From Bench Prototype to First Income

This is your first traction phase. You need to get your MVP out of laboratory or beta conditions and into the market. The sure sign of progress is verifiable traction, not theoretical traction. What is verifiable traction?

· Signed (and detailed) letters of intent with potential customers;

· Waiting lists of potential customers;

· Other form of investments in traction, e.g. R&D grants, freemium installations, etc.

Phase 3: From First Income to Recurring Income

Most seed investments today start from about $ 3-5 million. In order to attract investment, you need to be able to show annual recurring revenue (ARR), usually at least $ 1 million. There is no steadfast rule for this, but smaller early-stage investors are typically looking to place 30-50% of a $ 3 million seed round, while larger funds typically won’t look below $ 5 million due to the costs of arrangement and due diligence.

We are no longer in a zero interest rate environment, when money was being thrown at a few well-connected startups. Today, due diligence and investment pitching is an exhausting process, and the burden of proof is on the startup. There are very few sectors today where Fear of Missing Out (FOMO) is a driving force in startup finance.

My point is that if you are a Cypriot startup trying to raise a significant capital amount (say, over $ 1 million), you need to be in Phase 3 in most cases. Unless you need masochistic schooling, don’t approach investors if you don’t have some kind of recurring income and other verifiable traction.

Step 2: Know your VCs

The idea that you can go to a venture conference today and raise capital from investors without a lot of prior work is laughable. First of all, investors are overwhelmed in their daily work with pitching. I’m a small scale angel investor, and I’m receiving at least one unsolicited pitch on LinkedIn or via email every day, and besides this we generate one really good lead or idea each week internally or from our ecosystem. A larger VC is going to be receiving 25-50 pitches a day, many of them highly qualified.

The level of pitches at the Venture Summit was so good that I could easily tie up our available capital for the next 50 years on a tiny fraction of the startups I met in New York.

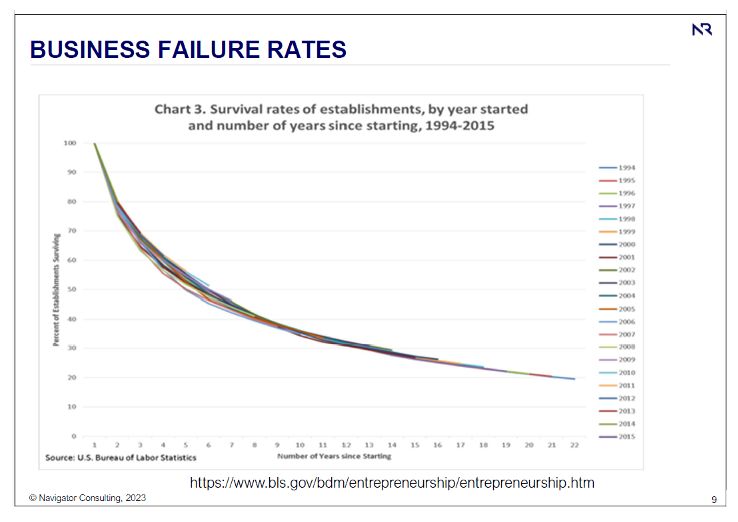

Second of all, investors are prepared for start-up failure. The idea of “faking it till you make it” rarely works anymore (although it did appear to work for some, like Theranos and FTX). I argue that, deeptech technical risk aside, venture capital today is a mature market, and part of the idea of a mature market is that investors know there is a massive failure rate for new enterprises and for tech startups.

Today, the emphasis is on technical and commercial verification. Your code will be examined by seriously qualified scientists. Your commercial data and finances will be gone over by forensic auditors. Your investors will ask for everything from a criminal record to your bank account data and tax returns.

While most high level conferences like Web Summit or Venture Summit have an online networking system, most investors are rarely on there. First of all, they are deluged with requests as soon as the system opens. Second of all, they are usually extremely busy and have their own investment priorities.

So, if you are going to raise funding:

· Know the investment thesis of the people you are raising capital from (wherever possible);

· Sculpt your pitch to their priorities;

· Contact them via a “warm” intro first; then meet them at a conference.

A warm intro is getting someone known to the VC make a qualified and forceful introduction.

Step 3: Be Ready to Go; Then Pitch

If you aren’t ready to go with a complete business plan, corporate data, team CVs, financial model and everything else, don’t pitch. If you do pitch and you get a positive response, you need to be ready to go through due diligence as rapidly as possible, sign a Term Sheet, and negotiate a SAFE Agreement or other legal agreement for the capital.

Step 4: Make sure you have a good Lawyer

A key aspect of being ready to go is to have a good lawyer on board. Term Sheets have become so complex today that unless you have a highly experience lawyer capable of interpreting and negotiating these agreements, you will probably get screwed. I’m not going to mince my words here: 98% of term sheets I see are heavily weighted in favour of the investor, and this includes seniority clauses, dilution clauses, further issue rights and a host of other benefits.

The idea that you can jot down the headers of an agreement on the back of a cocktail napkin, or that you can use a Term Sheet template, are largely delusional. At least most of the time. If someone is going to entrust you with $ 3-5 million, you can bet they will come to the negotiation loaded for bear.

And no, your friendly family lawyer is not a good choice for negotiating tech investments. Get a specialist.

Step 5: The Quadriga of Failure

As far as I can tell, there are four main causes of failure of startups:

a. There is no real market demand for the MVP, at least not at scale. There are sub-categories for this, e.g. a large competitor enters the market; regulatory change takes place, etc. The key is that what appeared to be interested on the benchtop does not scale in reality.

b. Corollary (b) is that founder and investor expectations for market growth defy reality, were underbudgeted or otherwise were unrealistic. Growth trends, pricing, team requirements, business processes and competitiveness at low scale rarely correspond to growth trends at large scale.

c. The team falls apart, is incompetent, is riven by internal divisions, and can’t perform, or can’t perform at scale.

d. The MVP fails due to technical reasons.

As a result, it is vital that your startup pitch, articles of association, positioning and work takes these into account.

Two conditions I am increasingly seeing in startup financing deals:

· The investors want to see a team member with previous experience of scaling (and ideally exiting) a startup.

· Any funds will be disbursed in phases, based on milestones, not in a lump sum.

And a condition you should definitely consider for your founder agreements includes exit agreements for founders and other equity-holding staff. If your equity holders are not performing, or burn out, or lose focus, you need to fix this fast. I would say that over 99% of startup statutes I see do not have exit clauses for founders.

Take these into account.

Step 6: Quantity has a Quality of its Own

Famously attributed to Joseph Stalin (among others), this apocryphal phrase has special relevance to startups. If you are scaling rapidly, then many other defects of your product or team can be overlooked.

Scale is invaluable. While this means different things in B2B versus B2C market segments, your primary goal after launch is scale. Make sure your use of funds permits you to scale. If you have raised capital to close phase 3 and you start to get scale but can’t support it, you are bound for failure. There is no time to raise more capital or adjust your team: you need to sell now. And your window of opportunity to remain first move will close more rapidly than you think.

This leads to a number of corollaries:

· Sometimes, the perfect is the enemy of the good. To get first mover advantage, you need to launch. The product may not be perfect, as long as it doesn’t lead to massive customer unrest.

· Rather than entering 10 markets in parallel, choose 1-2 markets that can support scale. More on this below.

For startups in Cyprus in particular: what realistic scale opportunities do you have in Cyprus? In Greece?

Step 7: Europe is not a Single Market

I don’t know how often I have to repeat this, but any comparison of the US versus the European Union quickly leads to this conclusion.

We are currently rolling out an all-electric, lightweight motorcycle for urban commuting. In the EU today, we have 27 Member States, but we also have 27 separate markets. This means we need:

· Technical manuals in 27 languages

· Warranty agreements in 27 systems

· A Sales Agreement in 27 legal systems

· Marketing copy in 27 different languages and cultures

· 27 different VAT and tax systems on our ecommerce engine

· In some cases, our ecommerce and accounting systems must be approved and automatically linked to the Ministry of Finance in some countries

· 27 different national systems for motorcycle regulation and driving culture

· 27 different bank accounts

· 27 different financing agreements

· 27 different influencers

· 27 different marketing and sales events to promote our business.

This is ridiculous. It’s a major drag on resources and effort.

Look at the United States: While there are important regional variations, it’s a single market. There is a single banking system and consumer credit system (and credit rating system). A single tax system (apart from state and local taxes, which are easily monitored and rarely change). And it’s a market that rewards innovation and success.

So, if you are a Cypriot startup planning to launch in Europe, rather than doing a pan-European launch, pick the largest 4-5 markets and demonstrate that you can achieve scale in them.

Step 8: Be Humble

And finally, be humble, grounded and focussed. The era of the messianic founder is probably over. Adam Neumann crashed and burned, taking billions in shareholder value with him. Elizabeth Holmes and Sam Bankman-Fried are in prison.

Take grounded steps, know what you are talking about, evaluate and accept your risks (and prepare for them). Running a startup is the hardest thing you will ever do. Succeeding at it is even rarer.

Step 9: Some sectors are sexier than others

Finally, always remember that the tech sector is heavily cyclical and driven by momentum. Getting funding for a physical product (like a motorcycle) is always difficult. Getting funding for a non-research-heavy SaaS startup is difficult, because investors don’t see the defensible moat. Getting funding for a research-heavy SaaS startup is difficult just … because. Always know what’s hot and what’s not. There are tons of tools for this, from the Gartner hype cycle to Dealbook or CB Insights. But just because an application is sexy does not mean you will succeed easily.

Step 10: Think about castles and moats

As you prepare to pitch, think about how you will protect your market position and IP. Can you register patents or trademarks? Is the IP defensible? If you take someone like Alphabet to court, will you win?

Any VC is going to be looking for factors that allow you to defend what you have achieved and launched legally. Keep this at the forefront of your mind, and your pitch.

I hope these comments are of use. They may be difficult to understand unless you’ve actually been in the position of raising capital, or with dealing with investors after raising capital. Please feel free to reach out to me on LinkedIn if I can be of any help.

About Philip Ammermann (Managing Partner Navigator Consulting and Partner & Expert at K2MATCH)

Philip Ammerman started his career working on large-scale organisational restructuring and privatisation of state-owned enterprise in New York and Dusseldorf. In 1995, he founded his own company, coincidentally in the year that the browser wars started and the Web 1.0 race began. In 2010, he and his partners began investing in startups, with an initial commitment to support one venture per year between 2010 and 2020. This commitment has been extended to 2030.

Philip is currently a co-founder of GR1T Motors, an all-electric lightweight motorcycle developed in Munich, Germany. He provides consulting and training in digital transformation and investment advisory services. Since starting his career, he has advised on over € 7 billion in completed investments as well as a further € 5 billion in technology acquisition projects. He is currently an advisor to the European Institute of Innovation and Technology (EIT); the EU Horizon Programme; the COFUND Programme; the Kreditanstalt fuer Wiederaufbau (KFW); and a number of venture capital firms and investment funds.