Decomplex - Your navigation system for efficient multigenerational family-legacy strategy execution

Managing the financial and non-financial wealth of multigenerational families requires risk transparency and operational efficiency, which is not easy to obtain because of its complexity. However, it is essential for the efficient navigation of family risks!

At DECOMPLEX AG, our mission is dedicated to enhancing the operational efficiency for family enterprises, empowering them for sustained success across generations. We are leveraging our combined expertise as seasoned IT entrepreneurs and active participants in family enterprises to pioneer the development of a cutting-edge family navigation software, fortified by the latest security standards.

Business families or families who have sold their businesses need to organise the management of their assets which includes tangibles such as liquid assets like stocks and bonds and non-liquid assets like real estate, direct investments, PE, and VC funds etc.

Many business or former business families institutionalise the management of their assets in family offices. With a bunch of humans holding assets there are various, interrelated risks that need to be managed and thus, we can define family offices as ‘Family Risk Managers’.

‘Family Risks’, are a complex portfolio of three major and highly interconnected risk domains:

· Financial Risks, which can be reduced to an asset-liability problem, as the asset base needs to fund the family’s lifestyle for generations to come.

· Operational Risks, i.e., how the family operates and behaves in practice compared to what the family has set out to do at the beginning of the year. This includes but is not limited to the existence of compliant risk-mitigation documents such as prenups, testaments etc.

· Behavioural Risks that arise from family dynamics and represent ca. 95% of the family risk portfolio according to one study.

Assets do not only pose risks, but they also provide opportunities such as to pursue a vison and mission the family has which is the basis for the ‘Target Operating Model’ which includes financial and non-financial goals the family formulates and ratifies. The inherent risk is that the targets are not met in time or not met at all, either because of the family’s behaviours or/and strategic risks that have not been anticipated.

We call this ‘Strategic Risk’ and add another risk domain to the trilogy family risks.

The DECOMPLEX software will help the family to monitor their behaviour in relation to the Target Operating Model and to anticipate geo-political risks and other risks by a special AI tool.

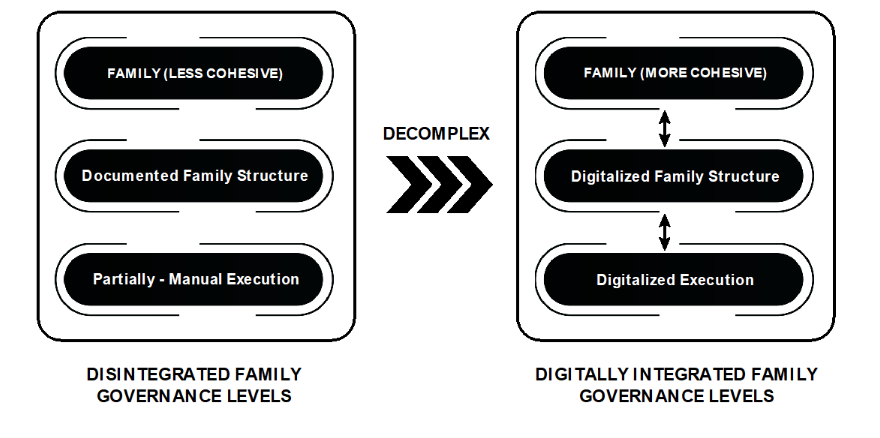

A typical mental structure to manage and navigate family risks is the 3-tiered, segmented family governance hierarchy, which is a practitioner model as illustrated below:

we neither find segments as fully functional unit nor is the vertical interconnectivity taken into account to the degree it should be if the family is to live its ‘Target Operating Model’.

DECOMPLEX AG is creating an AI driven software for consistency checks that support the creation and maintenance of functional units on a lateral level as well as the vertical connection of all segments.

Only segments that are functional units can be relied on. This is comparable to a chain, where the functional units are the links. High pressure will break the chain at the weakest link.

In the following paragraphs, we look at the levels and at some of the connections DECOMPLEX helps with.

Family

This module provides valuable information for strategic interventions and functions as early warning system for incoherence and is inspired by insights from research.

The family is the sovereign who is firmly in the driving seat to create socio-emotional and financial wealth over decades and centuries and to destroy it within weeks due to behavioural issues like inefficiencies in collective decision-making as a dysfunctional unit.

Family cohesion is the prerequisite for a family to become a functional unit, but this does not happen by itself.

First, the family needs to understand their level of cohesion and what it means for their wealth. DECOMPLEX AG have created a serious game the family plays together, and the degree of cohesion will be translated into a USD amount called Value at Behavioural Risk or V@BR).

It’s the amount the family may lose if they do not invest in the improvement of their cohesion levels.

Family heads with business acumen may not be convinced by anecdotical evidence where other families failed but are more open for discussions about family system intervention when the problem is communicated in a way they can relate to, i.e., the loss of hard-earned money and legacy!

Family system interventions are done by family advisors who can foster cohesion by skilled interventions with a family constitution at the end of the process.

Family constitutions usually contain principles how family members engage with each other such as values and give guidance on documents to mitigate family related operational risks and for the target operating model informed by the family’s vision and mission.

Signing the family constitution does not guarantee that family members abide by it, but DECOMPLEX AG provides a module that allows the family and family officer to understand where the family and family members stand in relation to the family constitution which provides vitl information for the family system maintenance.

Documented Family Structure

The family constitution is part of this segment, and so are all other documents that are informed by the principles laid down and agreed in the family constitution.

This includes documents like prenups, testaments, investment policy statements, shareholder and trust agreements, rules of procedures and whatever else the family has decided to have for their formal governance structure.

Usually, these documents are either in physical folders or stored as PDFs in secure formats to be retrieved by whoever has access rights to be viewed and compared for compliance checks which can be quite laborious.

The DECOMPLEX software translates the content of all documents by AI driven digitalization into electronic rules. That allows to verify the degree of compliance of the family’s actions and behaviours in relation to their own prescription. Thus, the module ensures high degrees of consistency, integrity and reliability of the information that is important for the efficient navigation of family risks.

Another module combining the top segment with the middle segment will allow to position the family on a Family-Risk-Matrix with one dimension being the degree of cohesion and the other dimension the degree of operational stability measured by the validity degree of the Documented Family Structure as functional unit.

Execution

What has been agreed as the Target Operating Model must now be put in action with various committees and family meetings, decisions, and actions in line with what the Documented Family Structure prescribes.

DECOMPLEX AG provides an AI driven module that creates operationable rules based on the Documented Family Structure and allows for automated checks-and-balances, which will help the family officer and the family to navigate family risks in accordance with their Target Operating Model via AI driven target-actual comparisons across all levels.

This includes a module that allow the active management of the m/patriarchs social network of professional contacts and relationships which goes way beyond the usual rolodex as it allows a graphical overview with qualitative information about the current state of the system, ready for any successor to take over even if the predecessor was suddenly run over by a bus.

“DECOMPLEX is the end of management by gut feeling” to quote our advisor Mike Haindl who’s the manager of his family’s SFO.

DECOMPLEX allows for the standardization of processes, provides better risk transparency by connecting all levels, which is pivotal for risk navigation, and it reduces operational risks in successions.

We invite you to reach out to us to get more information and a demonstration on how DECOMPLEX AG helps families and their family officers to navigate and manage family risks more efficiently.

Please reach out to:

Helmut Feindt, CEO Helmut.feindt@decomplex.ch

+41 173 301 0493